Customer verification

Verifi.life for Banking and Finance

As deepfake technology advances, indistinguishable human-like avatars are becoming more common in digital spaces. For banking companies, these AI-driven avatars pose significant threats, as they can be utilized to impersonate customers, employees, or executives, leading to fraud, data breaches, and reputational damage.

- Identity Fraud in Customer Interactions

Deepfake avatars can convincingly impersonate legitimate customers, potentially bypassing identity verification checks. This can result in unauthorized account access, funds transfers, and fraudulent transactions, harming both customers and the bank’s security reputation. - Internal Fraud & Data Breach

A deepfake impersonating an employee or executive could infiltrate internal banking systems, access sensitive data, or approve unauthorized transactions. This risk extends to internal communications and confidential meetings, where a fake identity could gather intelligence for cyberattacks or financial manipulation. - Compromised Video KYC (Know Your Customer) Processes

Banks increasingly rely on video-based KYC to validate customers remotely. A deepfake avatar could pass these verification processes, resulting in new account fraud or money laundering, ultimately threatening regulatory compliance and trustworthiness. - Executive Impersonation & Corporate Espionage

Sophisticated deepfake avatars mimicking executives could be used in interactions with other banks, partners, or even media, spreading misinformation or executing unauthorized decisions. Such breaches can lead to severe reputational damage and financial losses. - Loan and Credit Fraud

For processes involving credit applications, mortgage approvals, or large loan transactions, a deepfake avatar posing as a customer could access loans or credit without proper authorization, leading to large-scale financial fraud and loss.

Try it free, no credit card required.

Plans for Banking and Finance

Banking and finance are particularly vulnerable to fraud. The FTC just published a report that says that deepfake impersonations resulted in a loss for businesses of $2.7 billion in 2023; a total of over 3,380,000 fraudulent events.

Need a firm-wide strategy to tackle this kind of fraud before it becomes a problem? Contact us and we will package a solution tailored to your company.

AI-driven Fraud and Deepfakes: The Rising Threat to Financial Institutions

Laima Kuusaitė

Social Media Manager

October 16, 2024

Rise Of AI Face Clones Will Trigger A Fintech Identity Crisis

Forbes

Frank McKenna

FinCEN Issues Alert on Fraud Schemes Involving Deepfake Media Targeting Financial Institutions

verifi works with these, and many other video platforms

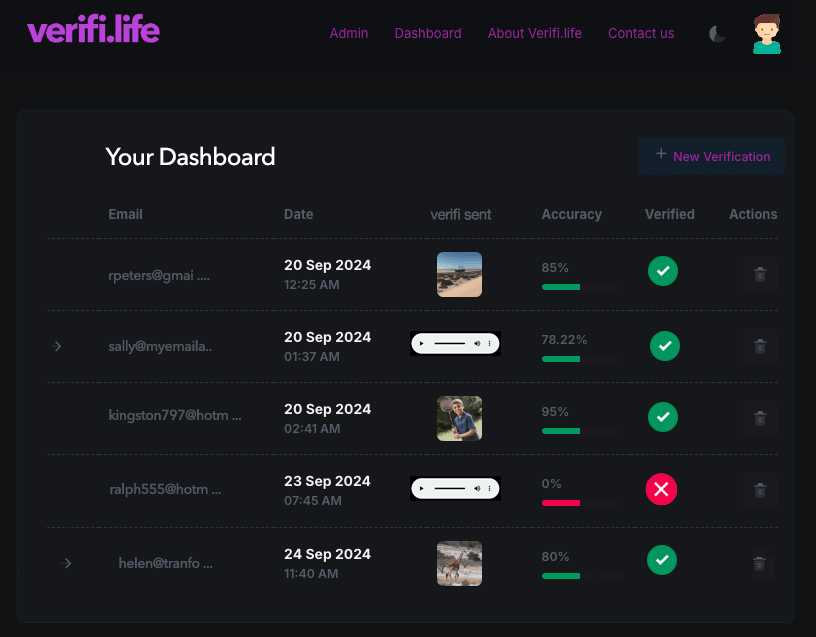

reporting

The record of every verifi.cation is stored in your account. Reports have a screen shot of the recipient you called together with all the relevant information you might need.

use it today

Simple to use.

Use verifi.life as an extension to your browser, or open it on a web page. It just takes a couple of clicks to get the assurance that the person you are talking to, is in fact, a person.

Try it free, no credit card required.